Offer only REALAT

Our agents

SEB: housing affordability improves in Riga in 2015

Still, housing affordability in Riga is much lower than in the other Baltic capitals.

In 2015, the SEB Housing Affordability Index (the maximum floor space a resident with average income can afford on a bank loan without taking excessive risks) for new apartments showed the biggest growth in Riga among the Baltic States. The index in Riga grew by 3.3 square meters to 27.9 square meters. In Vilnius, the index increased by 0.4 square meters to 29.6 square meters and in Tallinn the index dropped by 0.9 square meters to 35.7 square meters.

“The average price for new apartments in Riga suburbs in 2015 declined because of a drop of demand. As the minimum size of the investments a foreign investor has to make in Latvia to receive the residence permit has been raised to EUR 250,000, the new apartments in Riga suburbs are not bought with the aim to obtain a residence permit. In Tallinn, the housing affordability index for new apartments declined because there was a steep price growth for apartments in new projects,” said SEB Banka’s expert Edmunds Rudzitis.

Despite the drop of the index value, new housing is still more affordable in Tallinn compared to Riga and Vilnius.

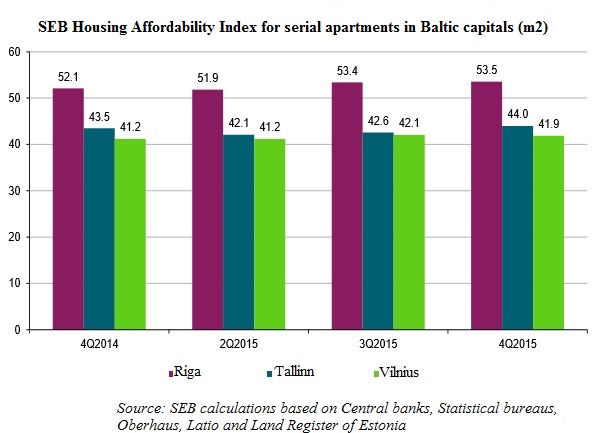

According to the SEB Housing Affordability Index, in the last quarter of 2015, the index value for standard-design apartments in Riga increased by 1.4 square meters to 53.5 square meters. The index value rose because of a wage growth that was steeper than growth of housing prices.

The Housing Affordability Index for standard-design apartments in Soviet-time housing in Tallinn increased by 0.5 square meters to 44 square meters, and in Vilnius the increase was 0.7 square meters to 41.9 square meters.

The SEB Housing Affordability Index shows the maximum floor space a resident with average income can afford on a bank loan without taking excessive risks. The index is based on four factors affecting the housing market – real estate prices, average wage, inflation and loan interest rates.

+371 67210010

+371 67210010

4 rm.

4 rm. 2 fl.

2 fl. 236.00 m2

236.00 m2